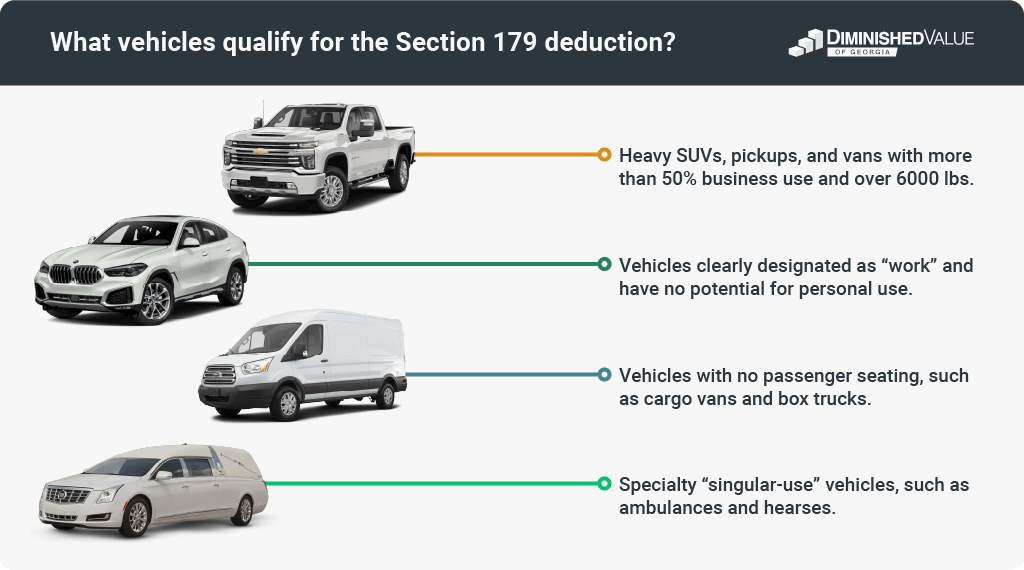

Section 179 Deduction Vehicle List 2024 Pdf – The deduction on such vehicles was capped following controversy over some business owners essentially buying luxury vehicles for personal use and writing off the full cost under section 179. . Long ago, in 1958 Congress passed one of its many laws making “technical corrections” to the Internal Revenue Code. Mostly, these are truly technical corrections but there are times when substantive .

Section 179 Deduction Vehicle List 2024 Pdf

Source : diminishedvalueofgeorgia.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comList of Vehicles Over 6000 lb that Qualify for the 2023 IRS

Source : www.taxfyle.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comList of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in

Source : diminishedvalueofgeorgia.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comList of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in

Source : diminishedvalueofgeorgia.comSection 179 Deduction – Section179.Org

Source : www.section179.orgSection 179 Deduction Vehicle List 2023: Does My Vehicle Qualify

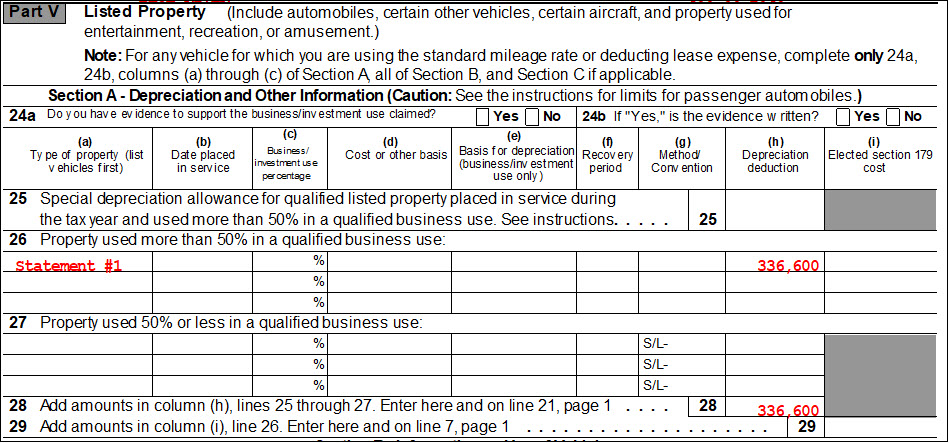

Source : www.voc.ai4562 Listed Property Type (4562)

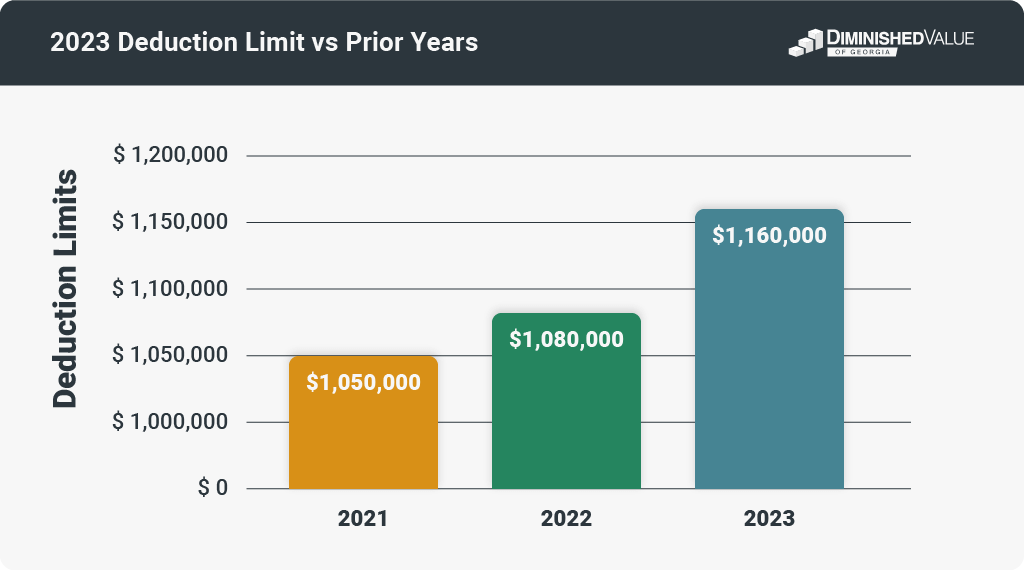

Source : drakesoftware.comSection 179 Deduction Vehicle List 2024 Pdf List of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in : Commercial vehicle sales are expected to see a boom as the year comes to an end, thanks to an expiring tax deduction. Section 179 of the U.S. Internal Revenue Code allows businesses to deduct up . Qualifying equipment includes business machines, office equipment, computer software and furniture, as well as vehicles that qualify for the write-off. For 2012, the maximum Section 179 deduction .

]]>